Considering a PayPal alternative for e-commerce should be in the interest of every business owner. Why? Loopholes such as high fees and delay in payment will result in cart abandonment. Shoppers tend to abandon items with high fees and when faced with payment difficulty.

And as an e-commerce merchant, cart abandonment is enough reason to think of an alternative payment gateway. This prevents you from losing customers, provides a good customer service experience, and creates various payment options for your customer. But before listing PayPal’s alternative for e-commerce, let’s have a glance at Paypal’s payment method.

PayPal’s Payment Method

Paypal is an online payment system that allows you to initiate payment for items purchased. It is one of the payment gateways used by most ecommerce business owners. In addition, it is a secured method that enables you to send and receive payment.

Signing up for a PayPal account is a start to enjoying various benefits from the platform, especially if you run a business and not a personal account. For example, business accounts accept multiple payment methods. Also, you can receive payment from customers via credit card customers who don’t have a PayPal account.

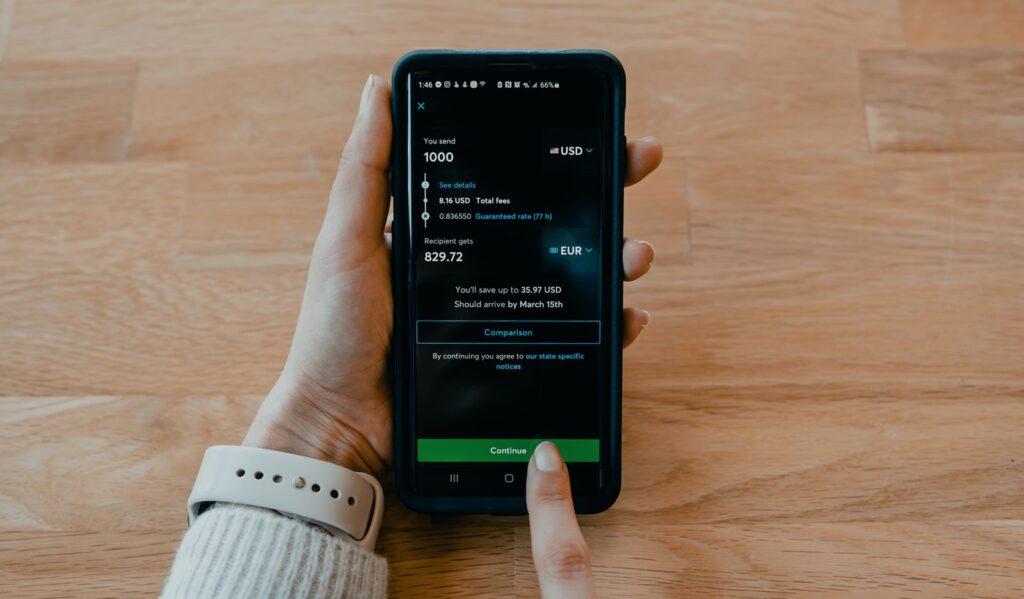

PayPal has a wide range of payment methods. They are; PayPal balance, bank account, PayPal Credit, debit or credit cards, and rewards balance. Permit me to take you through the steps to make payment.

1. Selecting a Preferred Payment Method

You can choose your preferred payment method from your account preference (www. PayPal.com) or the PayPal app. However, you must note that your preferred method could fail if you select an expired credit card.

As a regular e-commerce shopper, you can separate your payment method based on the types of transactions you run. There are online transactions and in-store transaction payment methods. The payment method you choose will be indicated as your primary payment method. The only challenge you might have is a limited payment method by the e-commerce website.

2. Backup Payment Method

If you are experiencing limited payment options or an expired debit card, you might need to back up your payment. It is an alternative payment method you can use for online transactions.

The backup payment method is displayed on your transaction review page for authorization before initiating payment. Note that currency conversion also requires backup payment.

3. Sending Money to Friends and Family

Friends and family is an option under the personal PayPal account. It gives you freedom to send money and digital gift cards to friends and family abroad. However, for you to be a beneficiary, both the sender and recipient must have a PayPal account.

4. Preapproved Payments / Automatic Payments

Some e-commerce websites allow you to save PayPal as your option payment to purchase items from their website. So whenever you visit their website, PayPal automatically appears as your preferred payment method. Let’s use Netflix for illustration.

One of the procedures to sign up for a Netflix account is the payment method. As a customer, you are expected to input the details of your prepared payment method for your monthly subscription. Worried? Don’t panic; your card details are saved with Netflix. To avoid repeating payment procedures, Netflix automatically takes the monthly subscription payment from your PayPal account.

5. Pay with Rewards

This is the last PayPal method of payment. Pay with reward allows you to make purchases from a few eligible e-commerce websites. Also, you may experience a limit or suspension. Your ability to redeem rewards may be terminated at any time. However, this is under the PayPal User Agreement and your card agreement and reward program terms.

Probably, this gave the role call for the need for a PayPal alternative for e-commerce. We have successfully gone through 5 payment methods for PayPal and seen the pros and cons. So, let’s dive into other payment alternatives for e-commerce merchants.

6 PayPal Alternatives for E-commerce

1. Stripe

Because of its versatility, Stripe is one of the payment methods used by e-commerce owners. If you operate a business with multiple processes and services, you should consider using. stripe. Some of the pros of Stripe are:

- It is developer-friendly. It offers you tools to customize your payment method.

- It supports both online and physical payment. So, if you run a brick-and-mortar store, consider adding Stripe POS to your payment gateway.

- For payment below $10, stripe fees are way lesser than other payment gateways. This encourages shoppers.

- You can accept payment from major credit and debit cards across the globe.

- To top it all, you can integrate alternative payment methods such as ACH Transfer, Apple Pay, Google Pay, and Masterpass.

Stripe will help your e-commerce websites drive sales, especially from mobile users.

2. Authorize.net

If you are looking out for PayPal alternatives for e-commerce, check authorized. Net. It is a recognized payment gateway in the world. One reason e-commerce business owners may avoid it is the startup fees. The setup fee for authorize.net is $49 with a monthly charge worth $25.

However, this doesn’t stop it from being a PayPal alternative payment method. You can integrate alternative methods with authorize.net. And if you seek a PayPal alternative for e-commerce with an advanced fraud detector, authorize.net is the best answer.

3. Square

Square is the best fit if you consider opening a retail store with your e-commerce shop. Initially, Square used to be a handy mobile device for payment. But this changed when it began to accept online payment for e-commerce. As an e-commerce merchant, if you want special and free POS software and a Mobile reader with various features, go for Square. You have the benefit to set up recurring payment methods free of charge.

4. Skrill

Do you encounter issues receiving international payments? With skill, International payment just got easier. Skrill is similar to PayPal regarding online configuration and gateway fees. So, worry less about your international trade. With skill, your customers can initiate international transactions.

5. 2CheckOut

Are you a merchant struggling to make waves in the global business market? 2CheckOut got you covered. With scalable modules, free startup, support of over 87 currencies, 8 payment methods, 15 languages, and sales in over 200 countries, tell me why you won’t consider 2check as a PayPal alternative for e-commerce.

2CheckOut software allows you to handle global payments, subscriptions, taxes, billings, and every other e-commerce payment. If you deal with international trade, 2CheckOut software is what you need. Just like authorize.net, it will help your website detect any threat or fraudulent activities.

6. PayCafe

Fraud and cybercrime have always been a threat to every e-commerce website. Therefore, there is a need to secure your website and business using the best fraud detector. For example, Paycafe uses an Al that scans every transaction for fraudulent activities. Once detected, you would be notified, and that’s the end of the transaction.

It consists of tools that will arm you against chargeback and a 24/7 customer support system. It features deem it fit to be a PayPal alternative for e-commerce.

Conclusion

This article has highlighted 6 PayPal alternatives for e-commerce website owners. It has also exposed you to five PayPal payment techniques. So, therefore, as an e-commerce merchant, you should consider these to provide alternatives and varieties of gateway payments for your shopper.